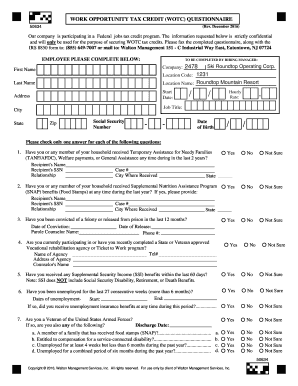

work opportunity tax credit questionnaire required

April 27 2022 by Erin Forst EA When you apply for a new job your employer may ask you to fill out a tax credit questionnaire on IRS Form 8850 Employment Training. As of 2020 the tax credit can save employers up to 9600 per employee with no limit on the number of employees hired from targeted groups.

Wotc By The Numbers Wotc Certifications Issued By Target Group 2008 2012 Cost Management Services Work Opportunity Tax Credits Experts

The tax credit amount under the WOTC program depends on employee retention.

. The tax credit for target group I long-term family assistance recipient is 40 percent of first year qualified wages up to 10000 and 50 percent of second year qualified wages up to 10000. After the required certification is secured taxable employers claim the WOTC as a general business credit against their income taxes and tax-exempt employers claim the WOTC against. Employers may ask you certain.

The Work Opportunity Tax Credit is a voluntary program. The Work Opportunity Tax Credit WOTC is a federal tax credit available to employers who hire and retain individuals from target groups with significant employment. Have applicants complete the questionnaire on the first page of Form 8850 on or before the job offer date to see if they qualify for one of the WOTC target groups.

Work Opportunity Tax Credit Program. WOTC is a voluntary program participation is optional and employees are NOT required to complete any WOTC paperwork or forms you provide. After the required certification is secured taxable employers claim the WOTC as a general business credit.

The Work Opportunity Tax Credit WOTC is a federal tax credit that the government provides to private-sector businesses for hiring individuals from nine target groups that have historically. Employers should contact their individual state workforce agency with any specific processing question See more. What Is the Paperwork Process.

An eligible employer must file Form 8850 Pre-Screening Notice and Certification Request for the Work Opportunity Credit with their respective state workforce agency within 28 days after the eligible worker begins work. This form is the Pre-Screening. File documents Submit the.

First complete an IRS Form 8850 before the employee starts the job. WOTC Eligibility Questionnaire The Work Opportunity Tax Credit program WOTC promotes workplace diversity and facilitates access to good jobs for American workers. A couple of jobs I have applied for have required me to complete the Work Opportunity Tax Credit as part of my application process.

The Work Opportunity Tax Credit is calculated as 40 of first-year eligible wages up to a maximum of 6000 per employee. Work Opportunity Tax Credit Authorization Center. If the employee completed at least 120 hours but.

The very first question is Are you under age 40 How is this. As such employers are not obligated to recruit WOTC-eligible applicants and job applicants dont have to complete the. Is a member of a targeted group before they can claim the tax credit.

Mailed applications will take longer to process. The credit is 25 of qualified first-year wages for those employed at least 120 hours but fewer than 400 hours and 40 for those employed 400 hours or more. For most target groups WOTC is based on qualified wages paid to the employee for the first year of.

Application Workflow Work Opportunity Tax Credit Wotc Avionte Aero

All About The Work Opportunity Tax Credit

Wotc Form Pdf Fill Online Printable Fillable Blank Pdffiller

Work Opportunity Tax Credit U S Department Of Labor

Employment Incentives Work Opportunity Tax Credit

The American Opportunity Tax Credit Smartasset

Wotc Wednesday Are The Work Opportunity Tax Credit Forms Required Youtube

Leo Work Opportunity Tax Credit

Wotc Calculator Management Tool Equifax Workforce Solutions

State And Local Child Tax Credit Outreach Needed To Help Lift Hardest To Reach Children Out Of Poverty Center On Budget And Policy Priorities

Completing Your Wotc Questionnaire

Wotc Work Opportunity Tax Credit Wotc Service Provider

Introduction To The Work Opportunity Tax Credit Cost Management Services Work Opportunity Tax Credits Experts

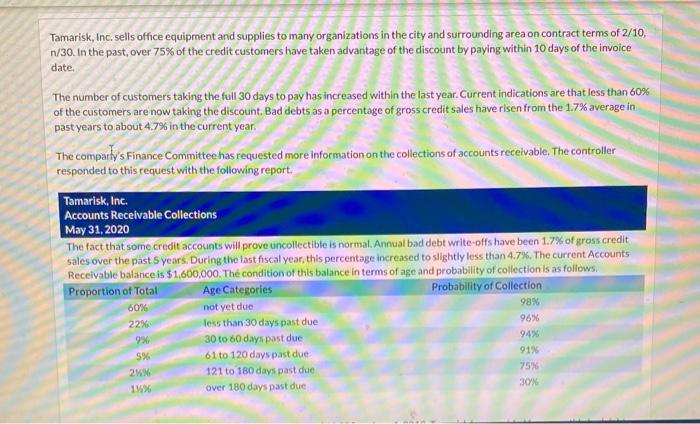

Solved Tamarisk Inc Sells Office Equipment And Supplies To Chegg Com

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

Edocument Equifax Edoc Avionte Classic

Completing My Work Opportunity Tax Credit Wotc Eligibility Questionnaire

Leveraging The Work Opportunity Tax Credit For Your Business